Quick, what’s your credit score? …….waiting…….waiting…..oh, you don’t know? Don’t panic, most people don’t know their credit score. Why would you? Who cares? Why is it important to know?

Well the answer is simple. Knowing your credit score, and how it can impact you, can save you thousands of dollars.

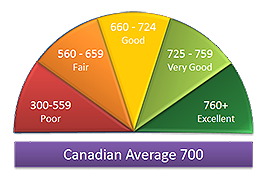

To understand the world of credit and how it can save you thousands, you first must know the basics of what your credit score is, and how it is measured. There are 2 aspects to your credit world. Your Credit Report, and Your Credit Score.

Your credit REPORT is a summary of your credit history:

-

It contains your personal information. Name, address, DOB, employer etc…

-

It also contains a review of all your past credit history. This includes all loans, credit cards, mortgages, lines of credit, and other credit vehicles you’ve used over your lifetime. It also shows any occasions where you’ve applied for credit and when your credit report was requested by a lender.

I get asked about sourcing your credit score from places like Credit Karma and asked if they sell your information to 3rd parties? Good news is, they don’t sell your info. The bad news is, they do sell tailored, targeted advertising by financial companies so after you open an account with Credit Karma, you may start to receive offers from various financial companies.

I recommend you source your credit report and score from either of the 2 agencies that monitor credit in Canada. You can request a free copy of your full credit report for free by mail. Best to check both agencies to see their guidelines.

Equifax 1-800-465-7166 www.Consumer.Equifax.ca

Trans Union 1-800-663-9980 www.Transunion.ca

Your credit SCORE is a measurement of 5 components:

-

Payment history 35% – Do you pay your bills on time, every time? Do you miss or skip payments? Do you pay less than minimum payments?

-

Utilization 30% – How much credit do you use? If you have for example $10,000 in credit available on a card, and your balance is $8,000, your utilization is 80%. Anything under 40% is optimal. Paying off cards monthly is ideal

-

Length of credit history 15% – How long have you been using credit? Most lenders require a minimum of 2 years of credit history, with at least 2 different credit vehicles open.

-

New Credit 10% – Have you recently opened any new credit vehicles? If you’ve recently opened several credit cards, this could cause a hit to your credit rating. Lenders view it as shopping for credit.

-

Types of Credit Used 10% – What credit vehicles are you using? Mortgage? Line of credit?