2021 Financial Reboot – 5 Steps to Take Now

As we recover from the insanity of 2020, and the financial stress that often comes with the Christmas Season for many families, it’s a great time to review your money and give your self a financial reset. For many of us, pre-covid, December is a whirlwind of shopping, eating out, travel and commitments. During Covid, zoom calls, social media connection, and online shopping. It’s easy to lose track of your money or to over-indulge.

If your finances are something you avoid, or hope things just work out, I encourage you to take control of your finances. Knowing where you’re at financially at all times actually reduces your stress levels. Time to Take Control.

Here’s 5 Steps you can take NOW to reset your finances for 2021.

Review Your Spending for December

This is your chance to review your spending for the Christmas season. Open up all your accounts so you can see everything and add up how much December cost you above and beyond your regular month. This is especially helpful, so you know for next year too. You can look and see what you spent your money on. There’s so much we forget about. Little stops here and there, that add up. Have a good look at WHERE you spent your money.

Analyse Your Numbers

After you’ve had a thorough look at everything, it’s time to do some basic math. Add up what you spent on different categories. How much on eating out? How much on gifts? How much on groceries? This step is critical to make sure you have a clear picture of EXACTLY how much you spent or overspent at Christmas. Does one category stand out? Identify spending that is out of your norm.

Debt Help

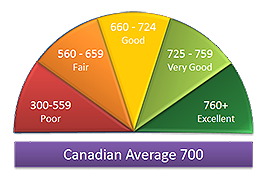

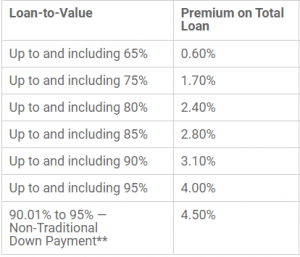

If you’re carrying credit card debt, lines of credit or other form of consumer debt, this is a perfect time to review and re-negotiate. Call your credit cards company, or lending institution and ask them to present you with any current promotions? Rate reductions? Bonus programs? You’ll be surprised what you can be offered. If you’re carrying several balances on high interest cards or lines, this is a good time to shop around and negotiate a consolidation load with lenders. By consolidating your debt, you can save your self thousands in interest costs as well as help repair/boost your credit rating. If you need a home equity loan, I can help you secure one to reduce your high interest debt and save you thousands in interest.

Review Your Policies

This is a great time to review parts of your finances you don’t normally look at. These include things like your car, home, life insurance costs. Make sure your coverages haven’t changed, or ask yourself whether you need more coverage? Call your insurance provider and conduct a full review with their help. While you’re at it, update your will, or if you don’t have one yet, time to get one done.

Planuary! January is the time to re-set your plan!

Once you’ve reviewed and analyzed your financial picture, it’s time to do the same to your monthly spending plan. Revise your numbers with your fixed expenses (mortgage, hydro, insurance etc.) and your variable expenses (Clothes, gas, entertainment etc). Take into account any changes in income, increases or decrease in regular bills, or debt re-payment. If you’d like a FREE template that does the calculations for your home spending plan, email me direct and I’ll send you a copy of one we use! joels@ndlc.ca

Wishing you happiness and money success in 2021~

Joel